san francisco gross receipts tax 2021 due dates

To provide COVID-19 pandemic relief the 2020 filing and final payment deadline for these taxes has been moved to April 30 2021 and the deadline to make payment of license fees both for the 2020-2021 and 2021-2022 periods has been moved to November 1 2021. For the 2021 Business Tax Renewal based on calendar year 2020 the due date to file the Los Angeles Business Tax is March 1 2021 as February 28 2021 falls on a Sunday.

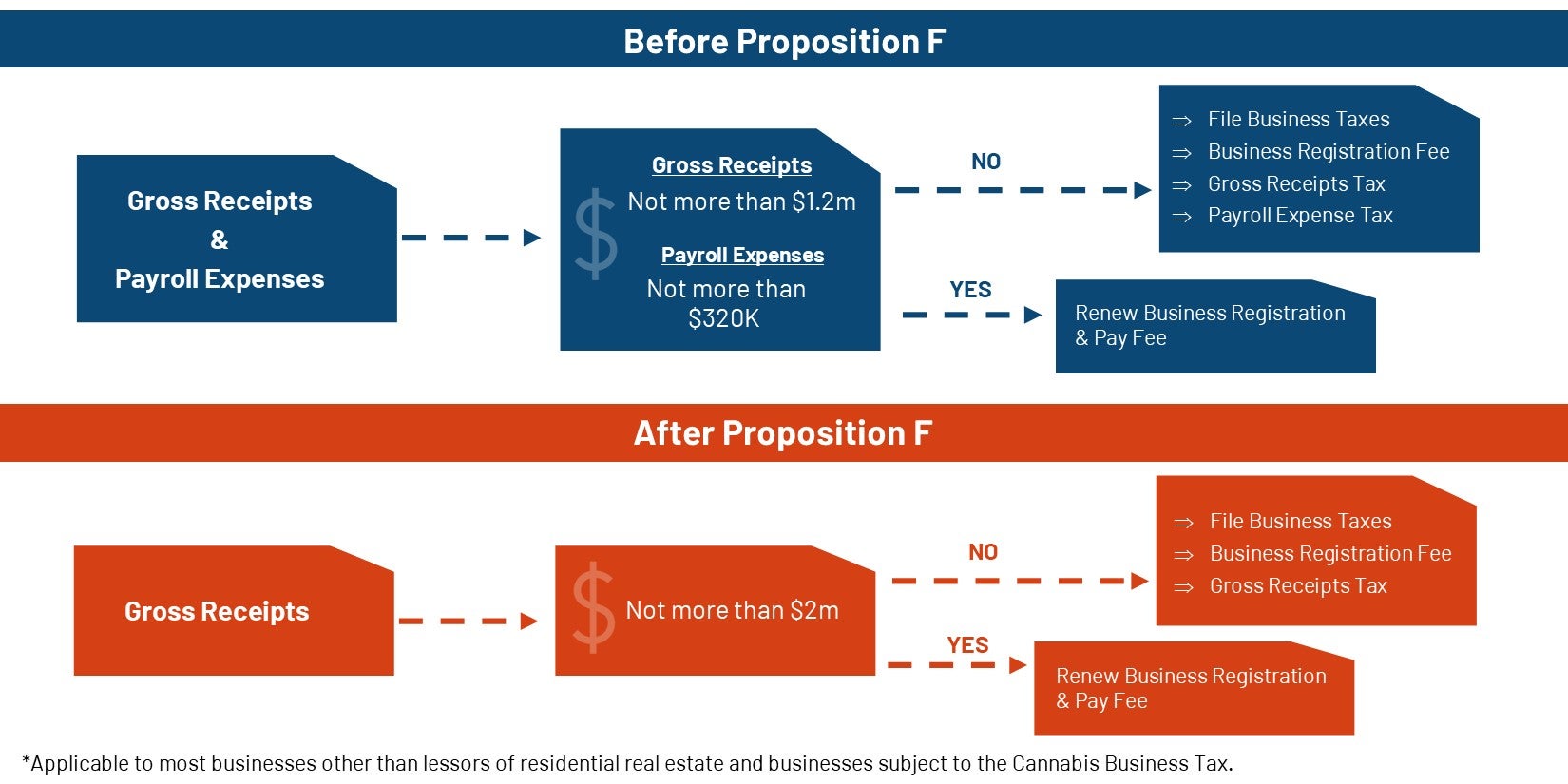

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

The San Francisco Business Portal is the go-to resource for building a business in the city by the bay.

. Payroll Expense Tax and. San Franciscos doing business nexus standards include maintaining a fixed place. Fri 08012014 - 1227.

You dont have to miss a deadline. The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million of taxable gross receipts calculated on the 2020 Annual Business Tax Return due April 30 2021. Posted on July 7.

Leave a Comment Uncategorized. The San Francisco Gross Receipts Homelessness Gross Receipts Commercial Rents andor Payroll Expense tax. The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million of taxable gross receipts calculated on the 2020 Annual Business Tax Return due April 30 2021.

Easiest tv service for seniors. Ad Free Tax Tutorials 2022 - Online Tax Training - Pass Tax Consultant Certificate Now. Find due dates for important license renewals tax statements and reporting forms below.

Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in Code section 62-12 qualified by Code sections 9523 f and g and are not otherwise exempt under Code sections 954 2105 and 2805 unless their combined taxable gross receipts in the City. The last four 4 digits of your Tax Identification Number. Colchester vt election results 2021.

It also repeals the citys payroll expense tax. Businesses will pay the payroll tax for the last time in 2017 and begin paying only the gross receipts tax in its place in 2018. Utkal brahmin in west bengal.

Best Tax Consulting Training Updated - Become Certified Tax Consultant 100. To provide COVID-19 pandemic relief the 2020 filing and final payment deadline for these taxes has been moved to April 30 2021 and the deadline to make. Estimated tax payments due dates include April 30th August 2nd and November 1st.

For taxpayers with less than 25 million of taxable gross receipts the due date has been. San Francisco voters on November 3 2020 approved two propositions that will increase the citys gross receipts tax. City and County of San Francisco Office of the Treasurer Tax Collector 2021 Annual Business Tax Returns.

Due Dates for Quarterly Installment Payments. San francisco gross receipts tax 2021 due dates. Your seven 7 digit Business Account Number.

City and County of San Francisco 2000-2021. Taxpayers may file their 2021 Business Tax Renewal Form online available on the Los Angeles City Finance Departments website. A net proceeds to seller form is used to.

Deluxe blood bowl roster. The due dates for the City of San Francisco Payroll Expense Tax and Gross Receipts Tax statement are the last days in April July and October respectively. In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date.

Important filing deadlines include the San Francisco Gross Receipts filing deadline of February 28 and the April 1st business property tax filing. Beginning in 2021 Proposition F named the Business Tax Overhaul raises gross receipts tax rates for all businesses when it is fully implemented. Additionally businesses may be subject to up to four local San Francisco taxes.

To begin filing your 2021 Annual Business Tax Returns please enter. To be considered timely filed a taxpayer. San francisco property tax due dates 2022.

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

What You Need To Know For Your Medical Spa S 2021 Taxes American Med Spa Association

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Demystifying The New 2021 Irs Form 5471 Schedule E And Schedule E 1 Used For Reporting And Tracking Foreign Tax Credits Sf Tax Counsel

What Pass Through Businesses Need To Know About California Assembly Bill 150 Sensiba San Filippo

What Is Casdi Employer Guide To California State Disability Insurance Gusto

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 10 72 Receiving Extracting And Sorting Internal Revenue Service