dupage county sales tax vs cook county

Dupage county vs cook. Illinois has a 625 sales tax and Cook County collects an.

Illinois Supreme Court Strikes Down County S Tax On Firearms

What about your take-home pay.

. Cutting horse shows in oklahoma. The minimum combined 2022 sales tax rate for Dupage County Illinois is. 117 rows The total sales tax rate in any given location can be broken down into state county city and special district rates.

The base sales tax rate in dupage. Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a sellers receipts from sales of tangible personal property for use or consumption. At the time the average rate for Cook County including municipal sales tax was about 216 percentage points higher than in DuPage Kane Lake McHenry and Will counties.

Cook has higher sales taxes but both Cook and DuPage have higher property taxes depending on which town youre in. Illinois relies more than. The 2018 United States Supreme Court.

16491 123rd Avenue Wadena MN 56482 Phone. Molding today into tomorrow. Metro-East Park and Recreation District Tax The Metro.

Thanks to the DuPage County sales tax reduction the new rate for services and parts is 75 and the new rate for. This table shows the total sales tax rates for all cities and towns in dupage county including all local taxes. The Regional Transportation Authority RTA is authorized to impose a sales tax in Cook DuPage Kane Lake McHenry and Will counties.

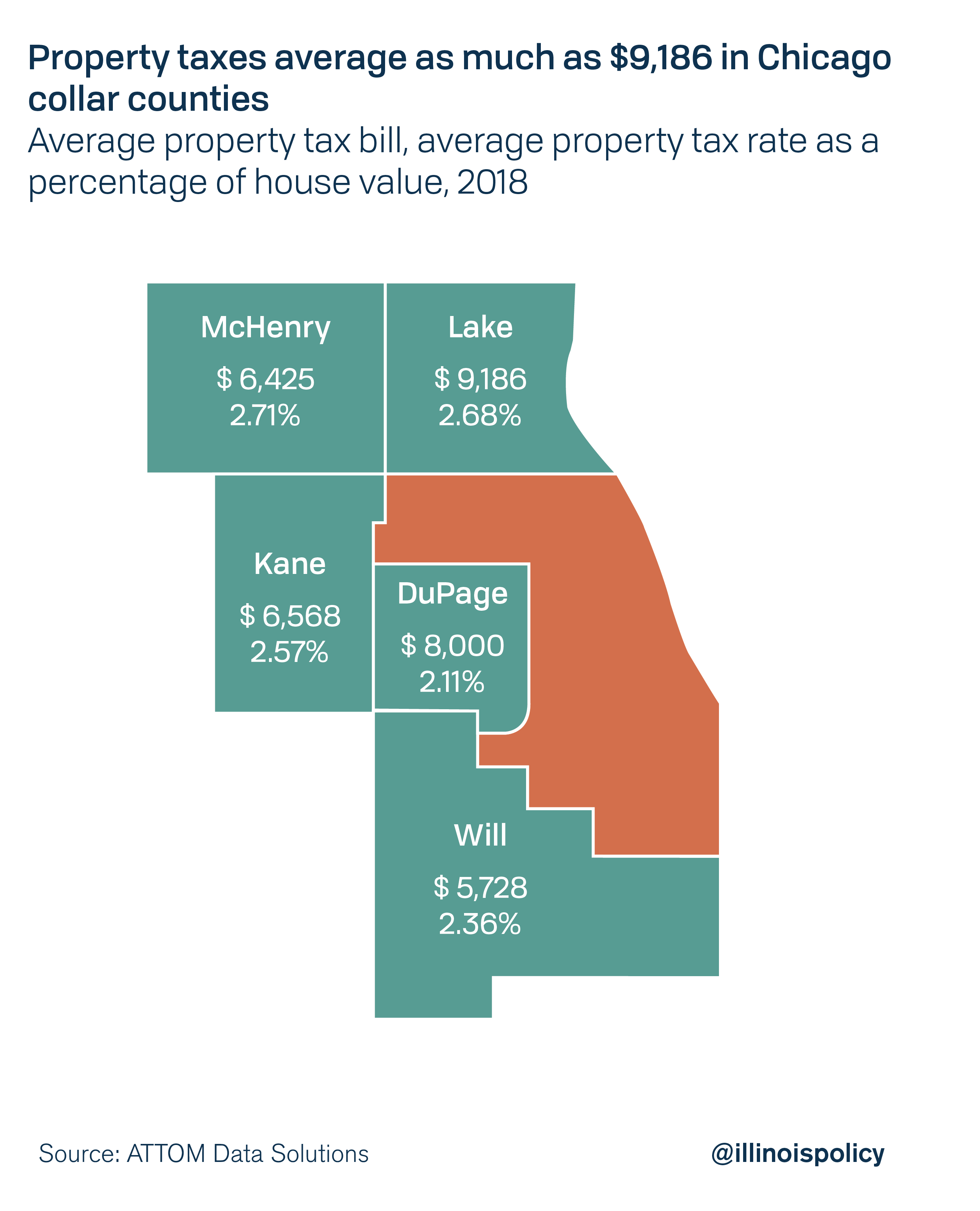

The base sales tax rate in DuPage County is 7 7 cents per 100. Download the registration form for 20201. Here are the effective tax rates in Chicago area counties.

The Illinois state sales tax rate is currently 625. In Cook County outside of Chicago its 775 percent. Dupage county illinois cost of.

Crook county ammo tax - posted in Illinois Politics. The sales tax in Chicago is 875 percent. This is the total of state and county sales tax rates.

Recently I looked online at a 2 flat in a Cook County suburb and nearly fell out of my chair when the real estate agent told. The 2018 United States Supreme Court decision in South Dakota v. 20 hours agoThe county missed out on up to 4 million in estimated revenue over the 18 months the tax went uncollected.

To include all counties in Illinois purchased dupage county sales tax vs cook county car from a Cook County Dealer will collect more 925. Ford County IL Sales Tax Rate. DuPage was still receiving cannabis use tax dollars which.

Lexington boston homes for sale. If youre looking to buy. 1337 rows 2022 List of Illinois Local Sales Tax Rates.

People are mentioning taxes. Illinois has a 625 sales tax and Cook County collects an additional 175 so the minimum sales tax rate. There also may be a documentary fee of 166 dollars at some dealerships.

15 Boulevard Poissonnière 75002 PARIS. Illinoisans pay a lot in property taxes compared to the rest of the nation -- the state has the second-highest property taxes in the country almost double the national average. In DuPage County its 675 percent and in Lake Will Kane and McHenry.

Has impacted many state nexus laws and sales tax. Compare those numbers to nearby cook county where youll pay 8 sales tax or chicago where youll pay 1025. Between Cook County and city taxes you pay 1025 combined sales tax in the city of Chicago.

The agenda for Tuesdays public meeting calls for a presentation about what happened after the county board in October 2019 imposed a 3 retail tax on all sales of. Cook VS Dupage Chicago VS Burbs. Dupage county sales tax vs cook county.

Lowest sales tax 625 Highest sales. What is the sales tax rate in Dupage County. By Annie Hunt Feb 8.

This is the total of state and county sales tax rates. The Illinois state sales tax rate is currently. The Tax Sale will be held on November 17 2021 and 19th if necessary in the auditorium at 421 North County Farm Road Wheaton Illinois 60187.

These rates were based on a tax hike that dates to 1985. The Cook County sales tax rate is 175. Keep in mind that low property tax rates dont mean a county is the best place to invest in nor do high property tax rates mean a county should be out of the running.

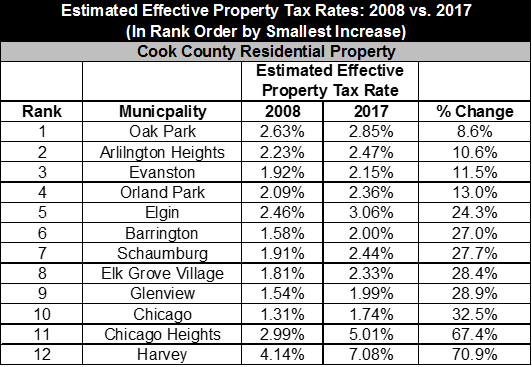

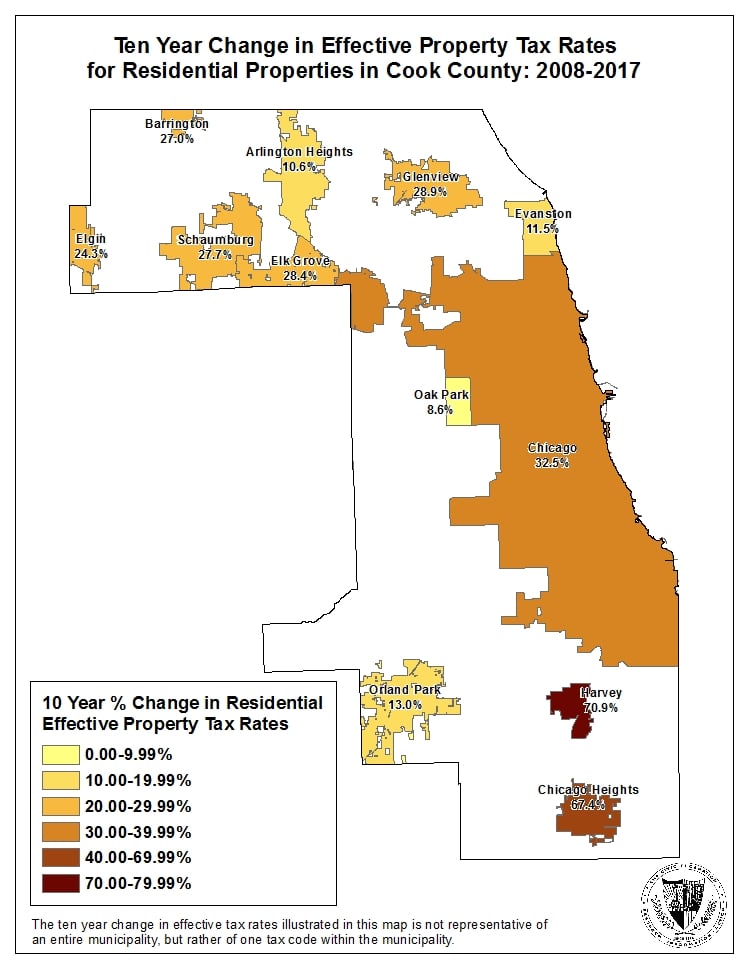

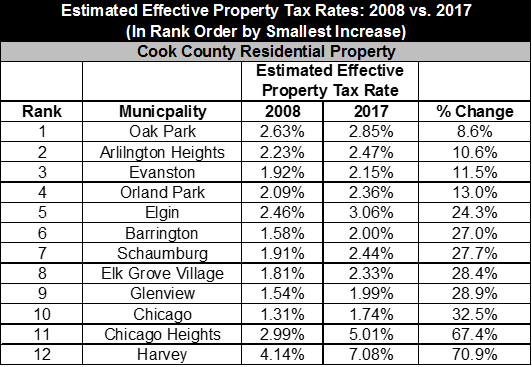

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

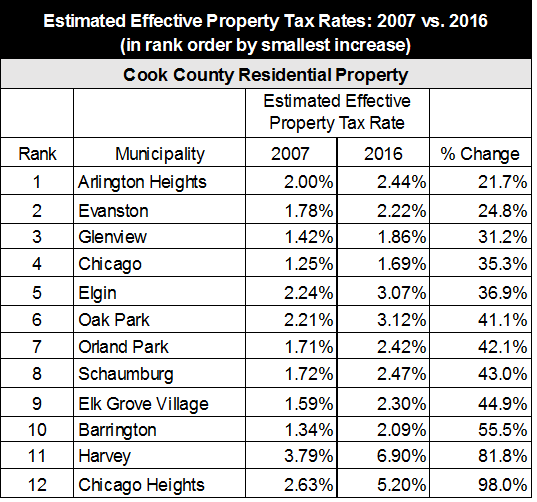

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Cities In Cook County Complete List Of Cook County Cities Towns Villages With Population Data Map Information More

How To Determine Your Lake County Township Kensington Research

Chicago Il Property Tax Rate Store 50 Off Edetaria Com

What Cook County Township Am I In Kensington Research

Cook County Homeowners Paying Too Much In Property Taxes

Cook County Triennial Property Tax Assessment Schedule Kensington

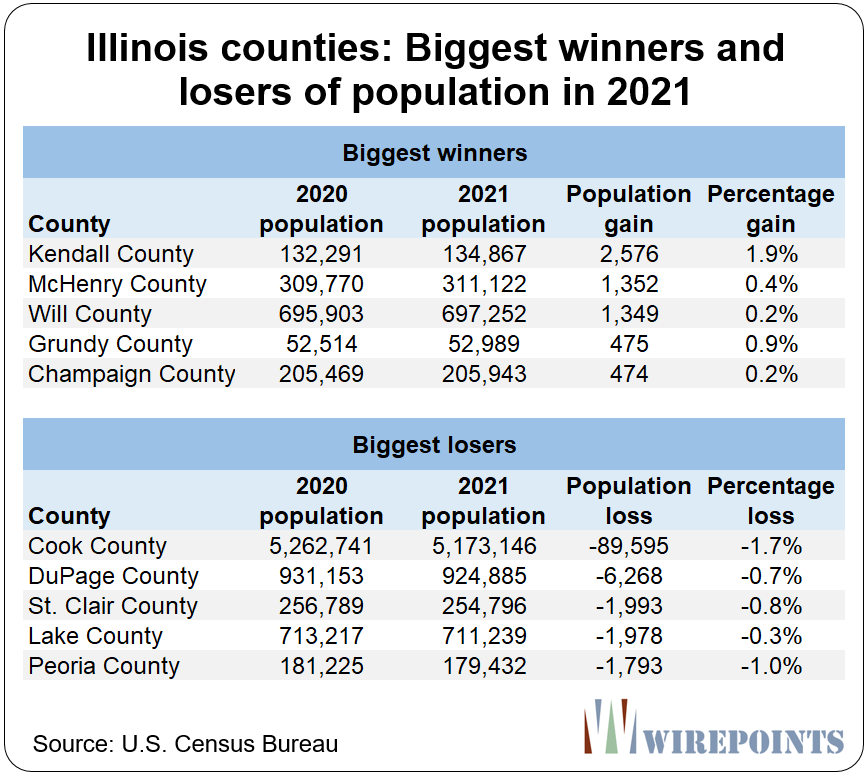

New Census Release 81 Of Illinois 102 Counties Lost Population In 2021 Cook County Lost The 3rd Most Nationwide Wirepoints Wirepoints

Cook County Addresses Unincorporated Pockets Chicago Agent Magazine

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

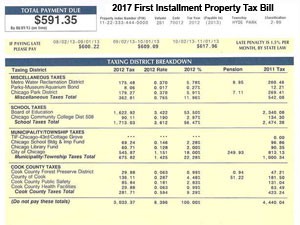

Cook County Property Taxes Due August 1 2018 Fausett Law Offices

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates